Table of Contents

ToggleThere is always a lot of anticipation around the proposed budget every year. There were many expectations set by the people for this budget. Finance Minister, Nirmala Sitharaman, in her speech, proposed the Union Budget for 2023-24 in which she stated attractive changes under the new tax regime. However, the old tax regime remained untouched.

Let’s begin by understanding the budget from a layman’s perspective. After that, we will discuss its impact on the debt market and equity market. Lastly, the impact of the changes made on the direct & personal tax from an individual’s perspective.

What exactly does a budget mean to a layman?

Budgets are nothing more than the government’s earnings and how they intend to use/spend them. This they do by spending it towards the country’s growth.

In India, our earnings are lower than our expenditures. This gap is called a fiscal deficit. The outlook on the debt market is determined by the fiscal deficit. A high level of borrowing is negative for the debt market. A lower borrowing rate is good for the debt market. The budget is all about spending money on the growth of the economy and the health of the equity market.

Post-COVID people across the world went ahead with an easy monetary policy. Easy monetary policy created excess liquidity. The interest rate goes down in the economy and in some of the developed markets, it was almost negligible or zero.

Under this scenario, people borrowed more to fund their personal aspirations. So because of this easy liquidity, the inflation rate went up rapidly. In order to cut this inflation again government started increasing the interest rate.

Liquidity going back created a problem & to further worsen the inflation impact there came the Russian-Ukraine war. Thus, amidst this, the world is today going through these 5 challenges:

- High inflation

- High-interest rate regime

- Uncertainty across the globe

- Headwinds in China

- Global recession.

India outshined in maintaining the growth momentum of fiscal prudence

India when compared to its global peers is doing very well. The budget was a brilliant budget that was given by our honorable Finance Minister Shimathi Nirmala Sitharaman, given this situation. India had two things to balance.

- One is to balance the fiscal deficit or ensure that the overall economic health of the country is intact.

- Two, ensure that the India growth story is not impacted.

The budget forecasted a nominal GDP growth rate of about ten and a half percent. Now, given current India’s growth, that number looks quite credible. The revenue receipts are expected to grow by 12%. This projection also looks very fair.

Now, it is very good to know that the revenue expenditure is growing by only 1.2%. This got reduced mainly by cutting subsidies for food and fertilizers. Another remarkable & enlightening factor is that the capital expenditure is growing by 30% expected to grow by 37%. Now when we manage and save our own money & we further invest that money & it grows in the future, and this showcases our growth. Similarly, in this budget the consumption of revenue expenditure is less & capital expenditure is high, stating the fact that the budget that came out is quite good.

Not only this the fiscal deficit of last year was very well managed at 6.4%, which is expected to go down to 5.9% in FY24. The government has a roadmap of fiscal consolidation to 4.5% by FY25-26.

Impact on the Bond Market:

The bond market carefully looks at the borrowing number that how much the Government of India is borrowing. The net borrowing announced by the government is 11.8 lakh crores. This amount is under the estimated amount that the bond market was expecting to generate. Thus, the bond market has favorably reacted to this budget.

Also, we believe that this is quite a positive move for the bond market. Going forward, the bond market in 6-9 months or by FY24 the interest rate cut can start. India will front lead this situation as India’s situation with respect to this is better than globally.

If the bond market interest rate gets cut then the long bonds will do extremely well. Hence, according to us, people should start investing in long bonds with a 3-year perspective.

Impact on the Equity market:

Since, this was the last full-time budget that the government would be presenting because, in 2024, there will be the Lok Sabha elections. The government in this budget has cut the revenue expenditure which came out to be a very welcome move. They have given a strong impetus to the capital expenditure while increasing it to almost 10 lakh crore. This turns out to be a great move as it will lead to India’s growth & its economy. This move helps create jobs for the youth too!

The impact will however take time. The equity market is fairly valued thus, no major immediate impact will be seen on the market. The good fundamental work that is happening in building the resilience of the economy will have a strong & long-lasting impact over the period of time. This, there will be no short-term bust in the equity market because of the budget.

However, because of the global uncertainty, there could be some turbulence or the market could be volatile. It is advised that you ride this volatility by staying invested via SIP or STP & focus on creating wealth over a long-term period.

Taxation impact: What’s in it for a common man?

The government has hinted new changes in taxes are favoring the new tax regime. Thus, if all the taxpayers move to the new tax regime then this will result in giving 35 thousand crores in the hands of the individual taxpayers. This could further fuel consumption-led to growth in the economy. This budget rightly targets capital-led growth & consumption-led growth through various initiatives.

There were quite a few changes in the personal income tax level. The government has introduced a choice new tax regime last year. But it was noticed that more than two-thirds of people opted for the old tax regime where a lot of deductions are given. From this budget, one thing is clear the government wants people to migrate from the old to the new tax regime, where there are no deductions and taxations are clear.

Also Read: Old VS New Tax Regime: Will Budget 2023 Affect Different Salary Brackets?

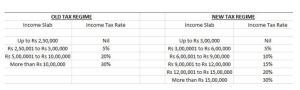

The new slab structure that they have introduced states that people earning up to 7 lakhs have to pay 0 tax. However, if you’re earnings are above 7 lakhs then the applicable tax will be as per the new tax slab mentioned below:

In the new tax regime, the government has given a standard deduction of Rs. 52,500 to salaried individuals & pensioners. Further to this, there is a change in the higher tax structure for people earning 5 crores & above the surcharge has been reduced from 37% to 25%. These changes are all in terms of personal income tax.

Besides this, there are 3 important changes from taxing investment have been introduced this year:

- Insurance premiums other than ULIP of greater than 5 lakhs will get taxed. The income from this will get added to your annual income & you will have to pay tax as per the tax slab.

- Income from market-linked debenture classified as long-term capital gains will be moved to short-term capital gains & will be taxed at the respective slab.

- From a real-estate perspective, you can now sell the property and invest the proceeds & buy another property to save capital gain tax under sections 54 & 54F. Any property over 10 crores & above will become a compulsory part of the long-term capital gain & you can’t save LTGC by investing in another property under section 50-54F.

Also Read: Best Tax Saving Investment Plans & Schemes for FY 2023-24