Table of Contents

ToggleInvesting is like an art where the key is to balance different types of investments to boost returns and lower risk. Sometimes stocks perform best, while other times gold or bonds do better. The goal for investors is to blend these assets in a way that minimizes ups and downs in the market and achieves steady growth over time.

The four main asset classes

Asset allocation is a fundamental principle in investing that refers to how an investor divides their investments across different asset classes such as stocks, bonds, real estate, and cash equivalents.

The four main asset classes typically considered in an investment portfolio are:

1. Equity (Stocks): Ownership shares in companies offering high returns through appreciation and dividends but with higher market risk.

2. Fixed Income (Bonds): Debt securities providing regular interest and principal repayment, generally less risky than stocks but with lower returns.

3. Real Estate: Investments in properties or REITs. Provide rental income, potential appreciation, and portfolio diversification. Less liquid than stocks and bonds, it can hedge against inflation.

4. Gold: Acts as a hedge against economic uncertainty and inflation. Can be held physically or through ETFs. Performs well in volatile markets but doesn’t generate income like stocks or bonds; valued for stability and as a store of value.

Why Is Asset Allocation Crucial?

So, why is asset allocation so crucial? How does it contribute to a well-rounded investment strategy that can withstand market volatility and help investors achieve their financial objectives?

Importance of Asset Allocation

1. Risk Management:

Different asset classes—such as stocks, bonds, real estate, and gold—exhibit different levels of risk and return. Stocks are generally more volatile but can offer high returns, while bonds tend to be more stable with lower returns. By spreading investments across these diverse assets, investors reduce the impact of poor performance in any single asset class. When one class underperforms, others might perform better, thus helping to balance and stabilize the portfolio’s overall performance.

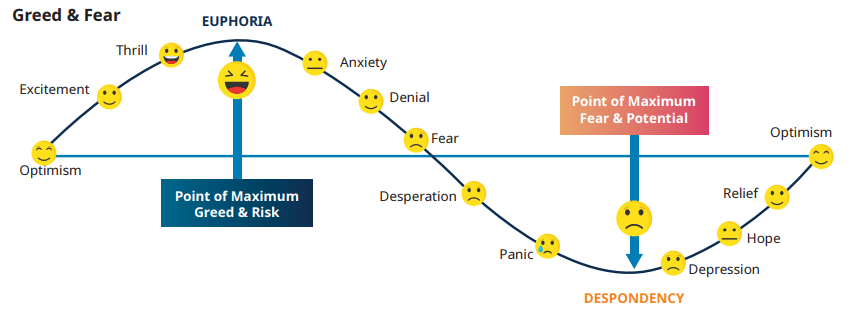

2. Psychological Benefits:

Investors often make irrational decisions driven by emotions such as greed and fear. For example, during market highs, the temptation to invest heavily in stocks can be strong – expecting the market to go even higher, while during market lows, the fear of further declines can lead to selling off investments prematurely.

Asset allocation helps by keeping you disciplined and reducing the impact of short-term market fluctuations. A well-diversified portfolio can help you stay calm and avoid impulsive decisions based on market ups and downs.

3. Drivers of investment results:

Research highlights that asset allocation is a major determinant of long-term investment returns. While picking individual securities and timing the market are important, they contribute less to returns compared to asset allocation.

A study from the Financial Analysts Journal in 2005 found that 91.5% of investment returns could be attributed to effective asset allocation rather than individual stock picking. This underscores the importance of choosing the right mix of assets rather than focusing solely on finding the best-performing securities.

Determinants of Portfolio Performance, published in the Financial Analysts Journal – 2005

4. Winners keep changing:

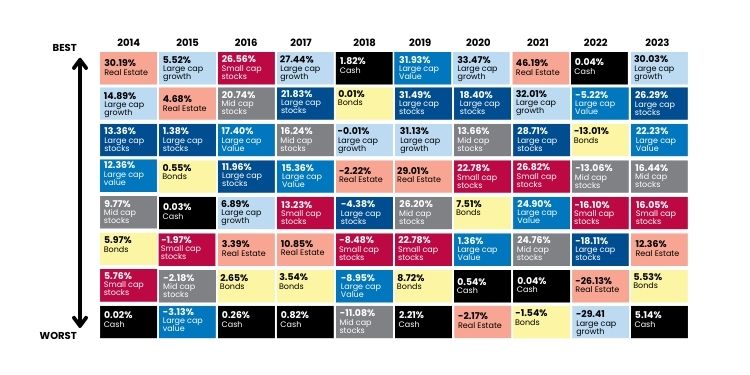

Different asset classes outperform or underperform each other in different phases or time periods.

A compelling illustration of why asset allocation is essential can be seen in the below chart displaying the performance of various asset classes from 2014 to 2023. This chart highlights how each asset class has performed year by year, with the top-performing asset class for each calendar year positioned at the top of each column. For example, large cap growth (sky blue box) has been the top performer four of the past 10 years, despite being the bottom asset class in 2022.

With changing market conditions, the top-performing asset class changes frequently. That is why it is important to have a balanced approach to investing and a well-thought-out asset allocation plan.

Source: Morningstar [Cash is represented by the Bloomberg US Treasury Bill 1-3 Month Index, Large cap growth stocks are represented by the S&P 500 Growth Index, Large cap value stocks are represented by the S&P 500 Value Index, Mid cap stocks are represented by the S&P Mid Cap 400 Index, Real estate securities are represented by the Real Estate sector of the S&P 500 Index, Bonds are represented by Bloomberg US Aggregate Bond Index, Small cap stocks are represented by the S&P SmallCap 600 Index]

5. Achieving Financial Goals:

Different financial goals require different strategies and the right asset allocation can support these objectives. For example, younger investors with a longer time horizon may allocate more to stocks for growth potential, while retirees may prefer a more conservative allocation with a higher proportion of bonds for income and stability.

6. Adaptation to market conditions:

Asset allocation allows investors to adjust their portfolios in response to changing market dynamics. For instance, maintaining a portion of investments in debt allows investors to capitalize on market corrections by reallocating funds into equities when prices are more favorable. Conversely, during periods of high market volatility or economic uncertainty, investors may shift funds from equities to debt for greater stability and risk mitigation.

Ready to grow your wealth?

Partner with Fincart for expert investment planning and make your money work for you.

Wrapping up

Deciding how to divide your investments among different classes of assets is important but can be tricky. It involves understanding markets and different kinds of investments. It is always recommended to seek help from a wealth management advisor who specializes in this area. They have access to detailed information and can make wise choices about when to shift investments between different types. Their experience can help make your investing journey easier and more successful.

We, at Fincart, understand the complexities of asset allocation and offer personalized guidance to help you navigate these decisions effectively.