When we think of gold, we instantly recognize how much people in our country value it. Gold has always been highly desirable in India, and over the years, this strong interest has made India one of the top gold consumers in the world.

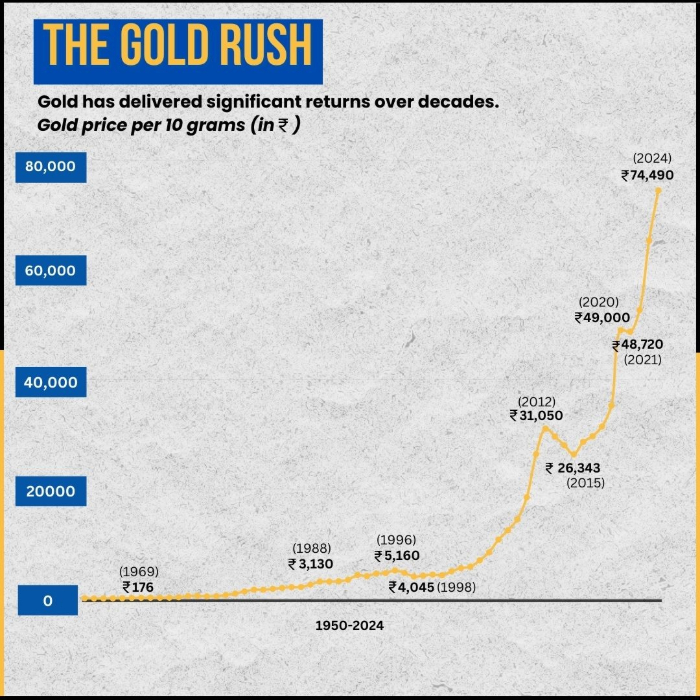

Gold Prices Over the Past Years

| Year | Price per 10 grams (INR) | Return |

| 1950 | 99 | – |

| 2000 | 4,400 | 4,344% |

| 2020 | 49,000 | 1,013% |

| 2024 | 74,490 | 52% |

The historical price data of gold showcases its substantial appreciation over time. For instance, in 1950, the price of gold was quite modest at Rs 99 per 10 grams. By 2024, it has surged to Rs 74,490 per 10 grams, providing a remarkable return of 750 times the original value. This translates to a Rs 1,000 investment in 1950 growing to Rs 7.5 lakh.

From 2000 onwards, when gold was priced at Rs 4,400 per 10 grams, it has provided a significant return of approximately 1,500%. During the 2020 pandemic, gold prices rose sharply to Rs 49,000 per 10 grams due to its reputation as a “safe haven” asset during economic uncertainty. This trend continued in the post-COVID period, with prices reaching new highs in 2023 and 2024.

However, it’s important to note that gold prices can be quite volatile. Factors such as economic instability, inflation rates and geopolitical tensions have all contributed to fluctuations in gold prices over the years.

The dilemma

As the appeal of gold as a stable and appreciating asset continues to grow, investors are faced with a dilemma: Should they invest in traditional physical gold or opt for the modern convenience of digital gold? Each option comes with its own set of advantages and challenges, making the decision less straightforward.

With physical gold, there’s the tangibility and traditional value associated with it. However, it comes with concerns about storage, security, and additional costs like making charges for jewellery. On the other hand, digital gold offers ease of purchase, secure storage, and typically lower costs. Digital gold investments, like Sovereign Gold Bonds (SGBs) and Gold ETFs, provide innovative ways to invest in gold without the hassles of physical ownership, but they also introduce new factors such as market liquidity and regulatory aspects. Let’s dive into a detailed comparison:

Digital Gold vs Physical Gold

| Feature | Physical Gold | Digital Gold (SGBs) | Digital Gold (ETFs) |

| Form | Coins, Bars, Jewellery | Sovereign Gold Bonds issued by the Government of India | Gold Exchange-Traded Funds traded on stock exchanges |

| Purchase | Available from jewellers, bullion traders, and government institutions like MMTC | Can be purchased during issuance periods through authorized banks, post offices, and online platforms | Can be bought any time through stock exchanges via stockbrokers |

| Storage | Requires secure storage at home or in a bank deposit box | Stored electronically, eliminating the need for physical storage | Stored electronically in a demat account, avoiding physical storage concerns |

| Security Risks | Physical risks such as theft, damage, and the possibility of purchasing impure gold | No physical risks as it is stored electronically, ensuring purity and authenticity | No physical risks, purity, and authenticity ensured as it is held electronically |

| Costs | Includes making charges (typically around 20% for jewellery), storage costs, and insurance | No making charges, offers an additional annual return of 2.5% along with capital appreciation | Involves brokerage fees and management fees, typically lower than the costs associated with physical gold |

| Liquidity | Highly liquid, can be sold at any time but may incur making charges and market price fluctuations | Redeemable after 5 years with an 8-year lock-in period; offers both liquidity and stability | High liquidity, can be traded on stock exchanges at any time, offering flexibility |

| Returns | Market-dependent returns based on current gold prices | Capital appreciation linked to gold prices plus an additional 2.5% annual interest | Market-dependent returns, closely track the price movements of gold |

| Taxation | GST (3%) on purchase, capital gains tax applies on selling depending on holding period | Capital gains are exempt from taxation upon maturity, making it tax-efficient | Subject to short-term or long-term capital gains tax based on the holding period |

| Collateral | Can be pledged as collateral for loans, typically up to 75% of the gold’s value | Can be used as collateral for loans, with banks offering loans ranging from INR 20,000 to INR 20 lakh | Can be used as collateral for loans, but requires conversion to physical gold first |

| Conversion | NA | Redeemed in monetary terms rather than physical gold | Can be converted into physical gold, though this involves additional procedures |

| Flexibility | Provides the physical ownership of gold, which some investors prefer for long-term security | Offers long-term stability with additional returns, suitable for those seeking a steady and reliable investment | Offers high flexibility for short-term trading and quick response to market changes |

Ready to grow your wealth?

Partner with Fincart for expert investment planning and make your money work for you.

Choosing one

Based on the analysis, Sovereign Gold Bonds (SGBs) are recommended as the best option for those seeking long-term stability and additional returns. They offer capital appreciation along with an annual interest rate, making them a favorable choice for steady returns. Additionally, SGBs offer tax benefits upon maturity, adding to their attractiveness as a long-term investment.

Gold ETFs come in as the second-best option for investors who prioritize liquidity and flexibility. They allow for quick responses to market changes and provide an easy way to invest in gold without the need for physical storage. These allow for easy buying and selling on stock exchanges, making them suitable for those who are comfortable with market fluctuations and are looking to capitalize on short-term movements in gold prices.

Lastly, physical gold is recommended for long-term investors who value the tangibility of the asset and are willing to handle the associated storage and security concerns. This option is best for those who prefer to hold gold for extended periods and appreciate the sense of security that comes with owning physical gold.

Need professional help?

So, are you ready to make your gold investment count? Whether you prefer the digital convenience of SGBs and ETFs or the timeless allure of physical gold, Fincart is here to help you navigate your options. Contact us today and turn your gold investment dreams into reality with Fincart!