Investors are constantly on the lookout for innovative opportunities that blend the advantages of various financial products. SEBI’s latest initiative, introduced on July 16, 2024, promises to address this need by proposing a new asset class that bridges the gap between Mutual Funds (MFs) and Portfolio Management Services (PMS). This new asset class aims to provide enhanced flexibility, higher returns, and better investor protection. With a minimum investment requirement set at Rs 10 lakh, this proposal is designed to cater to a segment of investors looking for more than what traditional MFs offer, but with a lower entry threshold compared to PMS. This article will explore how SEBI’s proposal can transform investment strategies and enhance investor options.

What is an Asset Class?

An asset class is a category of investments that have similar characteristics and behave similarly in the market. Traditional asset classes include:

- Stocks: Represent ownership in companies with potential for high returns but also higher risk.

- Bonds: Involve lending money to governments or corporations for regular interest payments.

- Real Estate: Involves owning property or land for income or appreciation.

Diversifying investments across various asset classes helps in spreading risk and achieving a balanced portfolio.

What is a New Asset Class?

A “new asset class” refers to a category of investments that is distinct from traditional ones, offering unique risk-return profiles and investment opportunities. This category is designed to fill market gaps and cater to specific investor needs not fully addressed by existing asset classes.

Bridging the Gap Between Mutual Funds and PMS

SEBI’s proposal introduces a new asset class that bridges the gap between MFs and PMS. This new category will offer a regulated investment option with:

- Higher Flexibility: Allows for more diverse investment strategies.

- Higher Risk-Taking Capability: Supports greater risk-taking compared to traditional MFs.

- Higher Minimum Investment Size: Set at Rs 10 lakh, making it more accessible than PMS but more substantial than typical MFs.

Example:

| Investor | Current Investment Option | New Asset Class |

| Mr. Aman | Mutual Funds (min. Rs 5,000) | New Asset Class (min. Rs 10 lakh) |

Mr. Aman, who finds the minimum investment for PMS (Rs 50 lakh) beyond his budget, can now access higher returns with a Rs 10 lakh investment in the new asset class.

What are the Eligibility Criteria for Mutual Funds/AMCs?

SEBI has outlined two routes for Mutual Funds and Asset Management Companies (AMCs) to qualify for offering products under the new asset class:

Route 1 – Strong Track Record

- Mutual funds must have been operational for at least 3 years.

- They should have an average AUM of not less than Rs 10,000 crores over the preceding 3 years.

- No actions should have been initiated against the sponsor/AMC under sections 11, 11B, and section 24 of the SEBI Act in the last 3 years.

Route 2 – Alternate Route

New and existing mutual funds not meeting Route 1 criteria can qualify if:

- They employ a Chief Investment Officer (CIO) with at least 10 years of fund management experience and managing an AUM of at least Rs 5,000 crores.

- They have an additional Fund Manager with at least 7 years of fund management experience and managing an AUM of at least Rs 3,000 crores.

- No actions have been initiated against the sponsor/AMC under the SEBI Act sections in the last 3 years.

This dual-route approach will broaden market participation, enhancing competition and investment options.

Registration process for the new asset class

The registration process involves:

Application Filing: Trustees/sponsors must file an application with SEBI, including fees and documentation.

SEBI Approval: SEBI will approve the applicant after verifying compliance.

Two-Stage Registration: Similar to MFs, the process will include in-principle and final approvals.

No Separate Infrastructure Required: Sponsors don’t need to maintain separate net worth or infrastructure for the new asset class; it will be an additional service under the existing mutual fund framework.

Minimum Investment Threshold under the New Asset Class

The proposed minimum investment amount for the new asset class is Rs 10 lakh per investor. This threshold aims to attract investors with significant investible funds while deterring retail investors. Systematic investment options like SIP, SWP, and STP will also be available under this new asset class.

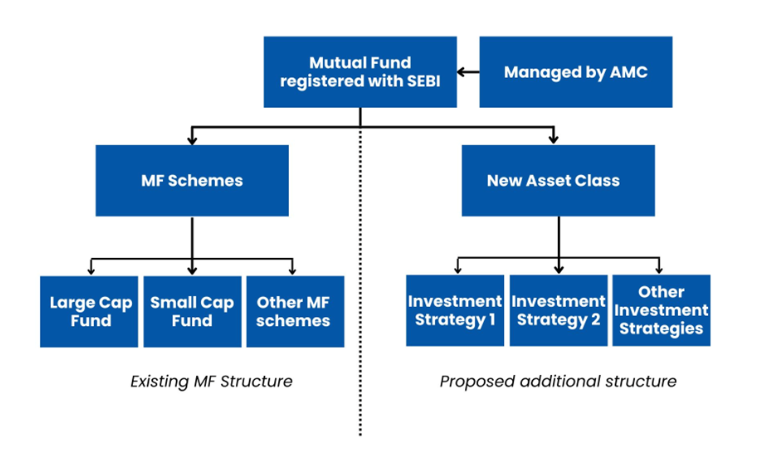

Defining the Structure of the New Asset Class

Investment Strategies: Under the new asset class, AMCs will be allowed to offer ‘investment strategies’ rather than traditional mutual fund schemes. They will be structured within a pooled fund, similar to mutual fund schemes.

Unlike typical mutual fund schemes that are often classified by their investment focus (e.g., large cap, mid cap), these strategies will offer a broader range of investment approaches.

Flexible Redemption Frequency: Redemption frequency can be tailored (e.g., daily, weekly, monthly, quarterly) based on the nature of investments.

Listing on Stock Exchanges: Units of investment strategies can be listed on recognized stock exchanges, especially for strategies with longer redemption frequencies.

Approval and Offer Documents: Strategies must be approved by trustees and SEBI, and all provisions of offer documents must be on par with those of mutual fund schemes.

Permitted Strategies: Only SEBI-specified investment strategies can be launched under this asset class. Strategies like long-short equity funds and inverse ETFs will be allowed.

Long-short equity funds involve taking long positions in stocks expected to perform well and short positions in stocks expected to decline. For instance, if the fund is optimistic about the automobile sector but pessimistic about the IT sector, it may invest by taking long positions in the automobile sector and short positions in the IT sector.Inverse ETFs are designed to provide returns that move in the opposite direction of an underlying index, which can be useful for hedging or speculative purposes.

Branding

To maintain a clear distinction between the new asset class and traditional Mutual Funds, SEBI proposes that products under the new category be branded and advertised separately.

Proposed Relaxations to Investment Restrictions for the New Asset Class

The new asset class will have relaxed investment restrictions compared to traditional MFs.

| Restriction | Existing Limits | Proposed Limits for New Asset Class |

| Minimum Investment Size | Rs 500 (some MFs accept SIP as low as Rs 100) | Rs 10 lakh per investor |

| Single Issuer Limit for Debt Securities | 10% of NAV (can extend to 12%) | 20% of NAV (+5% with approval) |

| Credit Risk-Based Limits | AAA – 10%, AA – 8%, A & below – 6% | AAA – 20%, AA – 16%, A & below – 12% of NAV |

| Ownership of Voting Rights | 10% | 15% |

| Investment in REITs/InvITs | 10% total, 5% single issuer | 20% total, 10% single issuer |

| Sector-Level Limits for Debt Securities | 20% in a sector | 25% in a sector |

| Derivatives Usage | Hedging and rebalancing only | Also allowed for market exposure |

The funds in this new category will be allowed to invest up to 20% of their NAV in a single debt security and up to 15% in shares of a single company, as opposed to the 10% limits set for mutual funds. The sector-level investment limit for debt securities has been increased to 25%, up from the previous 20%.

The credit risk-based limits for investments in debt securities have also been raised: up to 20% of NAV for AAA-rated bonds, 16% for AA-rated bonds, and 12% for bonds rated A and below, compared to the lower limits previously in place. The exposure limits to REITs and INVITs has also been doubled to 20% on aggregate, and 10% for a single issuer. Moreover, these strategies will be allowed to use derivatives not only for hedging and portfolio rebalancing but also for additional market exposure.

Ready to grow your wealth?

Partner with Fincart for expert investment planning and make your money work for you.

Concluding: How will the new asset class benefit investors?

The new asset class is poised to benefit investors who seek a regulated investment option with a risk-return profile that lies between traditional mutual funds (MFs) and portfolio management services (PMS). It offers an attractive solution for those who have investible funds between ₹10 lakh and ₹50 lakh and are currently drawn to unregulated investment avenues due to the lack of suitable options. By providing a structured and regulated platform, it addresses the needs of investors seeking higher returns and greater flexibility than MFs offer, without the higher minimum investments required for PMS.