Humans tend to make mistakes. But we surely know how to learn from our mistakes. Therefore, some mistakes could lead bring in negative consequences, like in the case of filing an ITR.

ITR could be filed either online or manually. Sometimes, filing ITR at the last moment leads us to create some mistakes, that bring in negative impact. But Don’t worry!

We have listed some of the common mistakes that you could avoid while filing an Income Tax Return.

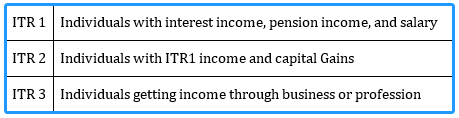

1. Selecting the Incorrect Form

It is very crucial to select the appropriate ITR form while filing for returns. An incorrect form will result in your return, leaving it not getting processed by the income tax department. The department will issue you with a defect notice with a time limit to rectify that mistake of yours.

For instance, if you are getting income from your business or profession then the suitable form for you will be ITR-3. But if you are salaried with an income of below 50lakhs and with no capital gains, then the suitable form for you will be ITR 1.

So make sure to select the appropriate form. This way you will be able to get your refund on time and without any additional hassles.

2. Incorrect Personal Information

Haste makes waste! Isn’t it?

Slow down and focus on the personal details while filing the ITR. Make sure to put in exact

personal details viz name, address, mail id, phone number PAN, date of birth, etc. Before sending it make sure to tally all the details with your PAN Card.

If you are claiming a refund, then check your bank particulars accurately. For instance, check your account number, IFSC code, etc., properly, so that the refund process can go on smoothly without any hassles.

3. Quoting the Wrong Assessment Year

This is where the majority of people fall for its prey! To avoid unnecessary penalties and chances of double taxation, make sure to mention the correct Assessment Year.

For example, for FY 2019-2020 the correct assessment year would be AY 2020-2021. For FY 2020-2021 the correct corresponding year would be AY 2021-2022 and so on.

Ensure a close look at this while filing ITR.

4. Not Disclosing All the Sources of Income

Taxpayers who have an additional income source other than the primary income, tend to not disclose it while filing an ITR. This is a blunder and it should be avoided, as you could be questioned by the tax authorities. Any income irrespective of it being taxable or exempt must be disclosed.

Income from all the sources including your savings accounts interest, fixed deposit interest, rental income, etc must be disclosed. For instance, capital gains are exempted from tax up to Rs 1 lakh but in the case of equity shares or equity-oriented mutual funds, the details of the gains have to be mandatorily mentioned.

5. Discrepancy in TDS details:

People tend to not verify Form 26AS before filing an ITR. Within the 26AS form inclusions like your income details, TDS, self-assessment tax, etc are mentioned. Make sure to check whether or not your employer has deducted taxes at the source on your salary.

Verify your details from Form 16 issued by the employer with Form 26AS. If the TDS is not reflected in your Form 26AS, you will not get a credit for tax deductions that are not mentioned in Form 26AS.

Being a taxpayer you have to make sure that the information in Form 26AS is updated and correct. Any discrepancy with your Form 26AS and Form 16 or TDS certificates might lead to a lesser refund or you might end up paying more taxes.

Making a meaningful impact on the lives of Indians across the globe with sound & profitable investments. That’s the FINCART dream!

![Read more about the article Income Tax e-Filing – How to File ITR Online? | [Jun’24]](https://fincart.com/wp-content/uploads/2024/02/2-1-300x150.jpg)