Table of Contents

ToggleIt’s the time for tax filing!!

But wait, do you know which income tax bracket your income falls in? This is a very crucial step to know, as the income level increases you will be taxed at different rates that are known to be the slab rates. Individuals who fall under this income tax bracket are required to pay a mentioned portion of their annual income tax in 2022. Well, in this blog we’ll be learning about:

Income tax slabs in India

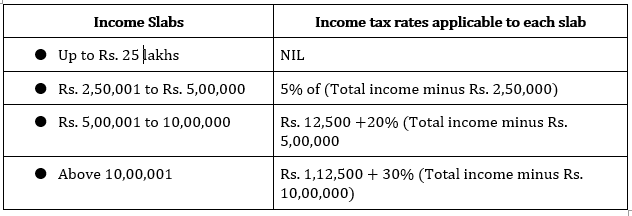

Resident individuals below the age of 60 years are eligible to come under the income tax slabs considering the old tax regime. Income above 50 lakh is applicable for a surcharge. Additionally, a rate of 4% cess on health and education will be added to the income tax in all cases.

Income Tax Slabs under the old/existing tax regime:

How to calculate your income tax bracket?

To determine your total tax expenses, you can use online income tax calculators. These online calculators determine the following pointers to calculate the tax liability:

- Annual income received from salary/ profits

- Income received from other sources like investments, rental income, etc.

- Mention tax exemptions, if any

- Lastly, HRA and travel allowance

For learning about your liabilities mention the accurate data considering the above pointers. If done properly, then your total tax liability will be demonstrated. Make sure to minus the taxes you already paid for TDS.

How to save on maximum tax?

Income Tax Department has come up with many tax-saving instruments, this is the reason why Tax planning is extremely important. Mentioned below are some deductions that you can claim and save maximum tax:

SECTION 80C: Deduction On Investments

Section 80C is all about investors & how they can save tax from the investments they make. See, this option to invest and save taxes is a combination that every taxpayer benefits from. This is because it allows for reducing taxable income by making tax-saving investments. Every year it allows a maximum deduction of Rs. 1.5 lakhs from taxpayers’ total income. This deduction benefit is both for the individuals and HUFs. Therefore, the companies or say the partnership firms, LLBs cannot avail of this deduction benefit.

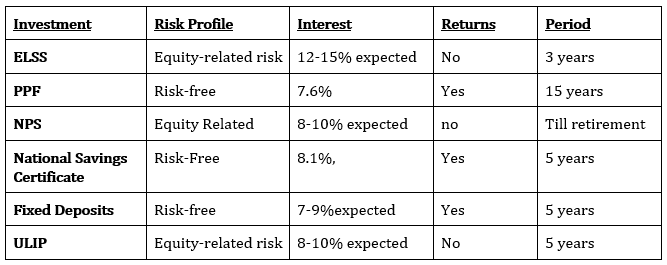

Mentioned below are some investments that are eligible for deduction under Section 80C:

SECTION 80CCD: National Pension Scheme (NPS)

Section 80CCD is the deduction you can claim under NPS which is National Pension Scheme. NPS, National Pension Scheme is known to be a voluntary pension scheme that is set up by the government of India. This scheme focuses on helping investors to save for their retirement pension and creating a corpus for old age.

Tax benefits on the NPS can be claimed through the 3 sections mentioned below:

Section 80CCD (1)

The maximum deduction allowed for employees deduction is the least of the following mentioned below:

- 10% of salary (in case the taxpayer is employee)

- 20 & of gross total income (in case of self-employed)

- Rs 1.5 Lakh ( limit allowed u/s 80C)

Section 80CCD (2)

Contribution of employers is allowed for deduction up to 10% of their basic salary plus dearness allowance or DA under this section. This benefit, under this section, is solely allowed to salaried individuals and not for the self-employed ones

Section 80CCD (1B)

For the amount deposited in the NPS account, an additional deduction of Rs.50,000 is allowed. Additionally, the contributions made to Atal Pension Yojana are also eligible for deduction.

SECTION 80D: Deduction for the Premium Paid for Health Insurance

Section 80D is the deduction for the Premium paid for Health Insurance. Having health insurance serves two purposes one is financially backing you and your family and secondly, it is a great source of tax savings.

Under this section, you can claim a deduction of Rs. 25,000 for self, spouse, and children. Not only this, there is an additional deduction for your parent’s insurance that is available up to Rs. 25,000 less than 60 years of age.

If your parents are aged above 60 years then the deduction amount is 50,000. This deduction amount was increased in Budget 2018 from Rs. 30,000. In a scenario where both the taxpayer as well as the parents are aged 60 years or above, then the maximum deduction one can claim is Rs. 1 lakh under section 80D.

For instance, if you are 65 years old and your father’s age is 85, in this scenario, the maximum deduction for you would be Rs. 1,00,000.