Table of Contents

ToggleIt’s the time of year when the Tax filing process starts again!! Every year this time many individuals become the victim of doubts & queries. A large section of people is not even aware that they come under the category of income tax slabs. Eventually, these are people who miss out on filing taxes & end up being summoned by income tax officers to pay penalties.

Well in this blog, your doubts related to Income Tax filing will be cleared:

Who is required to file an income tax?

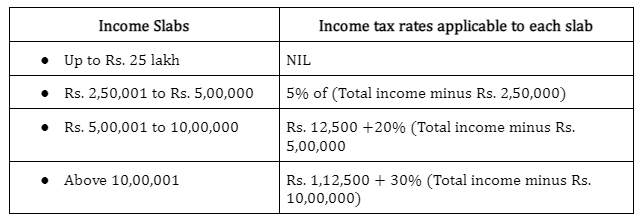

If your annual income comes under the mentioned tax slab, then you are obligated to file an ITR.

Income Tax Slabs under the old/existing tax regime:

Income Tax Slabs under the old/existing tax regime:

Apart from this, you should file an ITR if your total income has exceeded the basic exemption limit during the financial year. The basic exemption limit of an individual depends on their age.

However, if your gross total income does not exceed the basic exemption limit, then the mentioned below pointers makes you come under to pay taxes:

a) An aggregate amount exceeding Rs 2 lakh for himself/herself or any other person for travel to a foreign country;

b)If you have deposited an amount exceeding Rs 1 crore in one or more current accounts maintained with a bank or co-operative bank;

c)If you have paid an electricity bill exceeding Rs 1 lakh in a single bill or on an aggregate basis during the financial year;

d)Ordinarily resident individual having income from foreign countries and/or assets in foreign countries and/or having signing authority in any account outside India;

e)If an individual’s gross total income exceeds the exemption limit before claiming tax exemption on capital gains under sections 54, 54B, 54D, 54EC, 54F, 54G, 54GA, or 54GB.

What about the common mistakes one should avoid while filing an ITR?

We, humans, tend to make mistakes and learn from them. Tax filing is such a process that people might end up making mistakes. For instance,

- Selecting the Incorrect form while filing an ITR

- Adding incorrect personal information

- Quoting the Wrong Assessment Year

- Not disclosing all the sources of income

- Discrepancies in TDS details

Such mistakes could lead to negative consequences. Sometimes, filing ITR at the last moment leads us to make some mistakes, that have in negative impact.

What if someone doesn’t file an ITR, what would happen then?

Here’s what will happen if a taxpayer does not file income tax returns on time:

- The returns will be processed late and the refund amount will be late!

- Under Section 234F, a late filing fee will be applicable for filing returns after the due date. The charges of this penalty could go up to 10,000.

- For a small taxpayer, whose income is below Rs 5 lakh, the penalty will be Rs 1,000 if ITR is filed after the expiry of the deadline.

- Under section 234A of the Income Tax Act, a taxpayer will be liable to pay a penalty interest of 1% per month on the amount of unpaid tax.

- Not paying tax willingly even after receiving a notice from the Income Tax Department, you may face prosecution u/s 276CC of the Act.