When it comes to income tax filing in India, one of the most common points of confusion for taxpayers is understanding the difference between assessment year and financial year. According to the Income Tax Department, over 7.28 crore ITRs were filed for AY 2024-25, yet a large number of queries and errors reported every year are due to incorrect selection of the Assessment Year (AY).

In fact, data shows that nearly 10-12% of ITRs get revised or corrected because taxpayers either select the wrong AY or miss reporting income properly. This not only delays refunds but can also attract penalties.

In this article, we’ll simplify the concept of assessment year and financial year, explain why they are crucial for filing your Income Tax Return (ITR), and show how proper understanding can help you plan better and even save more tax.

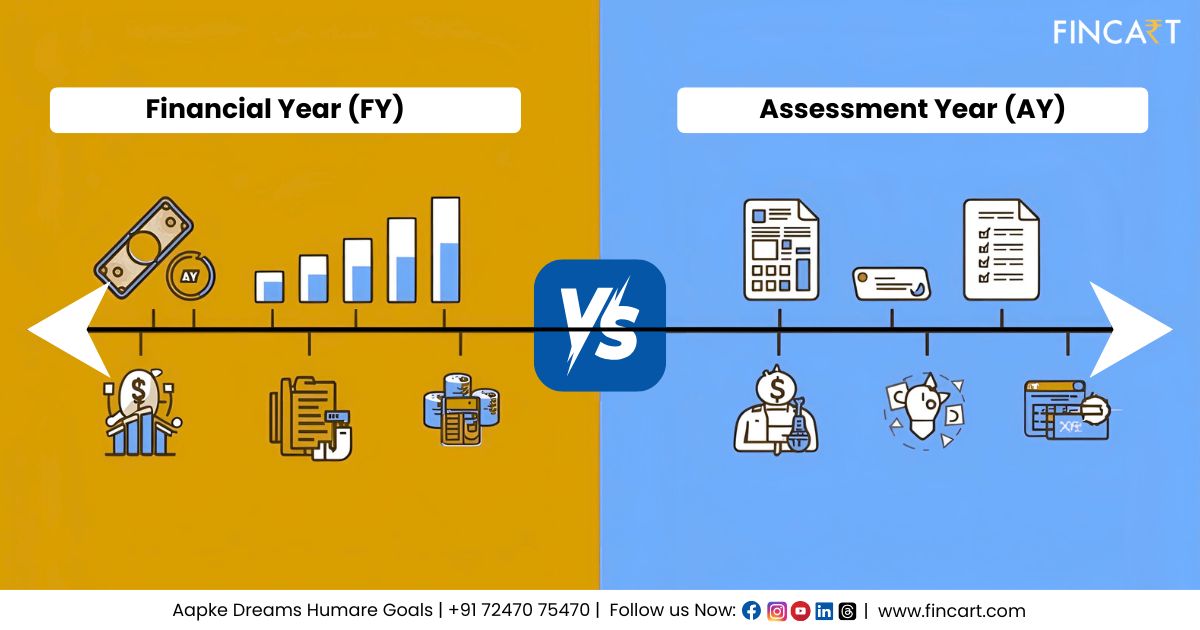

What is a Financial Year (FY)?

A financial year (FY) is the 12-month period during which you earn income. It starts on April 1 of a calendar year and ends on March 31 of the following year.

Think of the financial year as the time period in which all your earnings — salary, business income, interest, capital gains, or any other source — are recorded.

Example:

The financial year 2024-25 starts on 1st April 2024 and ends on 31st March 2025.

During this period, you will earn income, make investments, and manage expenses that could impact your tax liability.

Tax Planning Tip:

- If you have opted for the old tax regime, this is the year to maximize deductions under sections like 80C (investments in ELSS, PPF, EPF, life insurance) and 80D (health insurance premium) along with other deductions such as 24(b) for home loan interest.

- If you have opted for the new tax regime (default from FY 2023-24 onwards), most exemptions and deductions — including 80C and 80D — are not available. However, you benefit from lower slab rates and a higher basic exemption limit.

By deciding early which regime to opt for, you can make smarter financial moves throughout the year and avoid a last-minute rush.

What is an Assessment Year (AY)?

The assessment year (AY) is the year immediately following the financial year, during which the income earned in the financial year is assessed and taxed.

In simpler terms:

- You earn income in the Financial Year (FY).

- You declare and pay tax on that income in the Assessment Year (AY).

For example:

- For FY 2024-25 (income earned between 1st April 2024 and 31st March 2025), the Assessment Year is 2025-26.

- During AY 2025-26 (1st April 2025 to 31st March 2026), you file your ITR and pay any pending taxes for the previous year.

Key Difference Between Assessment Year and Financial Year

Here’s a simple table to make it clear:

| Point of Comparison | Financial Year (FY) | Assessment Year (AY) |

| Definition | Period during which you earn income | Period during which you file ITR and pay tax on previous year’s income |

| Duration | 1st April to 31st March | 1st April to 31st March (following year) |

| Purpose | To record and track your income | To assess, declare, and pay taxes on that income |

| Example (2024-25) | FY 2024-25 (income earned) | AY 2025-26 (income assessed and taxed) |

| Action Required | Do your tax planning, make investments | File your ITR, pay pending tax, claim refunds |

Why Are AY and FY Important for Taxpayers?

Understanding these terms is crucial for three reasons:

- Correct ITR Filing:

Choosing the wrong AY can result in your ITR being invalid. For example, if you earned income in FY 2024-25 but select AY 2024-25 while filing, your return may get rejected. - Better Tax Planning:

During the financial year, you can use tax planning services to reduce your taxable income — by investing in ELSS, PPF, NPS, or claiming deductions and others. - Timely Refunds:

Filing ITR in the correct AY ensures faster processing of your refund. Trusted tax consultants always double-check this before filing to avoid delays.

Examples to Understand Assessment Year and Financial Year Better

Let’s look at a few scenarios:

Scenario 1: Salaried Individual

Riya earns ₹10,00,000 salary during FY 2024-25.

- If she chooses the old tax regime, she invests ₹1.5 lakh in ELSS to claim the 80C deduction and reduces her taxable income.

- If she chooses the new tax regime, she does not get the 80C deduction but may still pay lower overall tax because of the reduced slab rates and standard deduction of ₹50,000.

Summary:

- FY 2024-25 → Riya earns salary, makes investments (if under the old regime), and reviews TDS on Form 26AS.

- AY 2025-26 → She files her ITR, pays any remaining tax, and claims a refund if excess TDS was deducted.

Scenario 2: Business Owner

Arjun runs a business and earns a profit of ₹15,00,000 in FY 2024-25.

- He must pay advance tax in four installments during the FY to avoid interest under Section 234B and 234C.

- At the end of the year, he prepares audited financial statements (if turnover exceeds audit limits).

Summary:

- FY 2024-25 → Arjun tracks business income and expenses, pays advance tax, and finalizes books.

- AY 2025-26 → He files ITR-3 with audited statements, pays any pending tax, or claims refund.

Scenario 3: New Source of Income (Rental Income)

Suppose you start earning ₹20,000 per month as rent from a property in October 2024.

- This rental income will be counted as part of your total income for FY 2024-25.

- While filing ITR in AY 2025-26, you must declare this income under the ‘Income from House Property’ head.

- You can claim a standard deduction of 30% on the annual rent (after deducting municipal taxes paid) — this benefit is available in both old and new tax regimes.

Summary:

- FY 2024-25 → Rental income starts in October, gets added to your annual income.

- AY 2025-26 → Declare this rental income while filing ITR and pay tax on it after deductions.

Recent Change – “Tax Year” Concept in Budget 2025

The Income Tax Bill 2025 has proposed the introduction of a “Tax Year” concept, which will replace both AY and FY to simplify compliance.

This means taxpayers will have a single term to remember — but until it is fully implemented, you still need to choose the correct AY while filing ITR for FY 2024-25.

Common Mistakes Taxpayers Make

Many individuals lose money or face penalties because of confusion between AY and FY. Here are the top mistakes:

- Selecting Wrong AY in ITR Form → Causes rejection of return

- Missing Deadlines → Leads to late fees under Section 234F

- Ignoring Tax Planning During FY → Results in paying higher tax than necessary

- Not Consulting a Professional → Increases chances of notices and mismatch issues

How Tax Consulting Services Can Help

Professional guidance can save you time, money, and stress. Here’s how Fincart’s tax consulting services make a difference:

- Accurate AY & FY Selection: Ensures your ITR is filed under the right year

- Tax Planning Services: Personalized strategies to legally save tax through deductions and exemptions

- Faster Refunds: Proper filing reduces errors and speeds up processing

- Compliance Assurance: Stay updated with the latest changes in tax laws and avoid penalties

When you work with an experienced tax consultant, you don’t just file an ITR — you build a roadmap to long-term financial efficiency.

Tips for Tax Planning During the Financial Year

Here are actionable tips to make the most of your FY:

- Plan Early: Don’t wait till March to invest; start tax planning from April

- Track Your Expenses: Keep receipts for medical, tuition fees, home loan interest, etc.

- Use Section 80C Fully: Invest in ELSS, PPF, or EPF to maximize ₹1.5 lakh deduction

- Consider Health Insurance: Premiums qualify under 80D deduction

- Opt for Professional Advice: A qualified tax consultant can help you optimize your liability and avoid errors

Key Takeaways

- Financial Year (FY): Year in which income is earned

- Assessment Year (AY): Year in which income is assessed and taxed

- For FY 2024-25, the relevant AY is 2025-26

- Correct understanding helps you avoid penalties, get faster refunds, and plan taxes better

Final Word

The difference between assessment year and financial year is more than just a technicality — it directly impacts your tax compliance, refund timelines, and financial planning. Whether you are a salaried employee, business owner, or professional, knowing these terms helps you stay ahead of deadlines and avoid unnecessary penalties.

Filing ITR can feel overwhelming, but you don’t have to do it alone. At Fincart, our expert tax consulting services and tax planning services ensure a hassle-free filing experience, optimized deductions, and maximum refunds.

Avoid the last-minute rush — book your consultation today and file your ITR confidently!