For most people, tax season ends once the return is filed. But the real anxiety begins when an unexpected income tax notice lands in the mailbox. Even a small error—like forgetting to report interest income or a mismatch in Form 26AS—can draw the Income Tax Department’s attention. While the idea of dealing with a notice may sound stressful, the truth is most of them are avoidable. All it takes is accurate reporting, timely filing, and smart financial discipline. With the right approach—and guidance from expert tax consulting services or a trusted tax consultant—you can stay compliant, minimize risk, and enjoy a worry-free tax journey. In this blog, we’ll break down why people receive income tax notices, the common mistakes to avoid, and how a trusted tax consultant can help you stay compliant while saving more in the process.

Why Do People Receive Income Tax Notices?

Before learning how to avoid them, it’s important to understand why income tax notices are sent. Common reasons include:

- Mismatch in Income Reporting – When the income you report doesn’t match data available with the IT department (e.g., Form 26AS, AIS, or TIS).

- Non-Filing of Returns – If you’re required to file but fail to do so.

- Excessive Deductions or Claims – Claiming deductions you are not eligible for or without proof.

- High-Value Transactions – Large property purchases, investments, or bank deposits not explained in ITR.

- Unreported Foreign Assets or Income – Failing to disclose overseas investments or accounts.

- Cash Transactions Above Limits – Heavy cash deposits/withdrawals that raise suspicion.

- Scrutiny Based on Risk Parameters – Random scrutiny or pattern-based detection by IT algorithms.

The tax department is becoming increasingly data-driven. With systems like AIS (Annual Information Statement) and data-matching tools, even small inconsistencies can raise red flags.

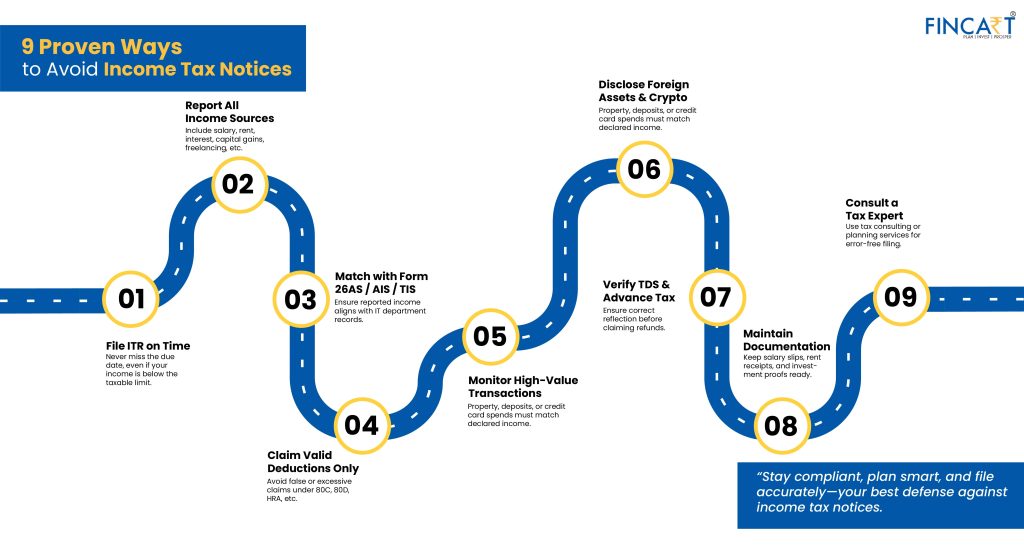

Proven Ways to Avoid Income Tax Notices

Here are actionable strategies to help you avoid getting income tax notices and maintain peace of mind:

1. File Your Income Tax Return on Time

Late or missed filing is one of the most common reasons for notices. Ensure you file before the due date, even if your income is below the taxable limit (if you’ve had high-value transactions, filing is still recommended).

Pro Tip: Set a reminder in June or July, so you don’t wait till the last day in September/October.

2. Report All Sources of Income

Many taxpayers forget to include:

- Freelance/side business income

- Rental income

- Interest from savings accounts, FDs, or bonds

- Capital gains from shares, mutual funds, or crypto

Failing to report such income can result in notices. Ensure your ITR reflects every income source.

3. Match Your Income with Form 26AS, AIS, and TIS

The Income Tax Department collects details from banks, employers, mutual funds, and other institutions. Always cross-check your income with:

- Form 26AS (tax deducted at source)

- AIS (Annual Information Statement)

- TIS (Taxpayer Information Summary)

Mismatch = possible notice.

4. Avoid Excessive or Wrong Deductions

Taxpayers often make mistakes while claiming deductions under Sections 80C, 80D, 24(b), etc.

- Don’t claim without proof (e.g., insurance premiums, tuition fees, ELSS investments).

- Avoid over-reporting HRA or home loan interest deductions.

A good tax consultant ensures deductions are claimed correctly, helping you maximize savings without triggering suspicion.

5. Keep an Eye on High-Value Transactions

The IT department monitors:

- Cash deposits above ₹10 lakh in savings accounts

- Property purchases above ₹30 lakh

- Credit card spends above ₹10 lakh annually

- Large investments in mutual funds, shares, or bonds

If these don’t align with your declared income, you may get a notice.

6. Disclose Foreign Assets and Crypto Holdings

With tighter global tax regulations, unreported foreign bank accounts, property, or cryptocurrency investments can lead to strict notices and penalties.

7. Verify TDS and Advance Tax Payments

If TDS (Tax Deducted at Source) or advance tax has been deducted/paid, ensure it’s reflected in your Form 26AS. Claiming a refund without matching TDS details is a red flag.

8. Maintain Proper Documentation

Always keep:

- Salary slips

- Rent receipts

- Investment proofs

- Bank statements

- Loan repayment details

In case of scrutiny, these documents are your best defense.

9. Use Reliable Tax Filing Platforms or Experts

DIY filing is good—but it is prone to errors. By using professional tax planning services or consulting an experienced tax consultant, you can avoid mistakes, claim accurate deductions, and stay compliant.

How Tax Consulting Services Help You Stay Notice-Free

Even if you are diligent, the Indian tax system can be complex. This is where professional tax consulting services make all the difference.

Benefits of Hiring a Tax Consultant:

- Error-Free Filing: Ensures accuracy and prevents mismatches.

- Optimized Tax Planning: Helps you save tax legally through smart structuring.

- Updated Knowledge: Tax consultants stay updated with the latest changes.

- Representation in Case of Notices: If you still receive a notice, a tax consultant handles responses and representation.

For both salaried individuals and business owners, investing in expert guidance means fewer chances of notices and better peace of mind.

What to Do If You Receive an Income Tax Notice?

Even after precautions, sometimes notices arrive due to system errors or minor mismatches. Here’s how to handle them:

- Don’t Panic – Not all notices mean penalties. Some are just information requests.

- Read Carefully – Understand the type of notice (u/s 139(9), 143(1), 143(2), etc.).

- Cross-Check with Your Records – Verify documents and statements.

- Respond Within the Deadline – Always reply within the stipulated time to avoid escalation.

- Seek Expert Help – Consult a tax consultant for drafting the right response.

Smart Tax Planning = Fewer Notices

The best way to stay worry-free is through proactive tax planning services. Instead of last-minute scrambling, plan your taxes at the start of the financial year. This includes:

- Investing in eligible tax-saving instruments

- Managing advance tax payments quarterly

- Structuring salary components smartly

- Keeping investment and expense proofs ready

When you plan your taxes strategically, your returns are cleaner, deductions are valid, and notices become rare.

Final Thoughts

Getting income tax notices can be intimidating, but most of them are preventable with timely filing, accurate reporting, and proper documentation. With the help of professional tax consulting services and guidance from an experienced tax planner, you can not only avoid notices but also ensure smart tax savings year after year.

Remember, tax compliance is not just about avoiding penalties—it’s about financial discipline, transparency, and long-term peace of mind.

So, stay informed, plan ahead, and file responsibly. That’s the surest way to keep tax notices away!