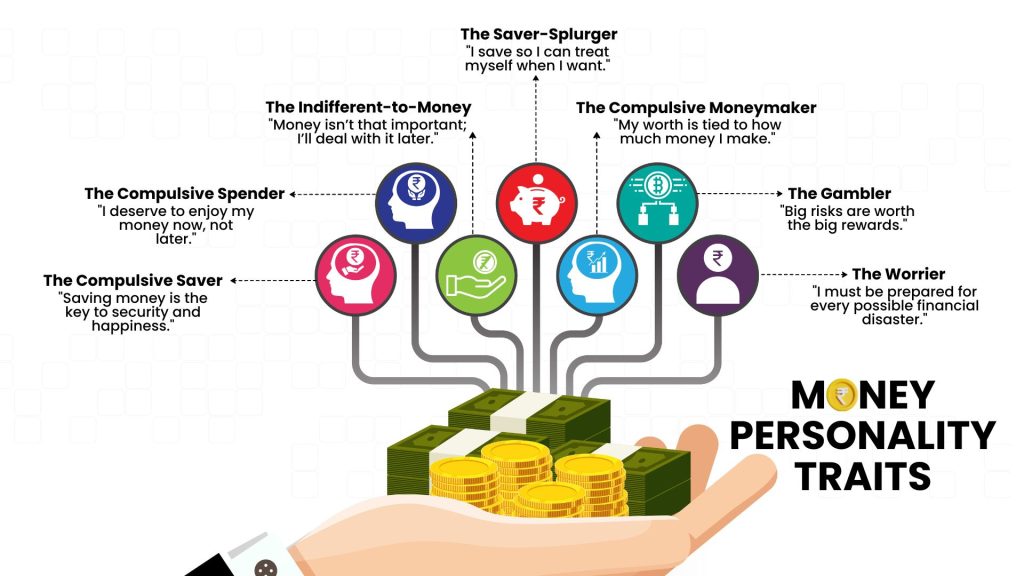

Everyone has a unique relationship with money that influences how they save, spend, and invest. Understanding your money personality can help you make smarter financial decisions and avoid common pitfalls. In this article, we’ll explore seven money personality traits, how they affect your financial decisions, and provide practical advice to manage your money better.

What’s Money Personality?

Your money personality refers to your unique mindset, habits, and behaviours regarding money, shaped by your experiences, values, and emotions. It influences how you earn, spend, save, invest, and handle financial risks.

For example, some people prioritize saving and financial security, while others enjoy spending on experiences or luxury items. Understanding your money personality helps you identify strengths and weaknesses in your financial habits, enabling better decision-making.

By recognizing your financial tendencies, you can create a balanced approach to budgeting, saving, and investing, ensuring financial stability while still enjoying life. Awareness of your money personality allows you to make conscious choices that align with your long-term financial goals.

1. The Compulsive Saver

Compulsive Savers are extremely diligent about saving money.

Signs that you might be a “Compulsive Saver”:

- You save money obsessively, often at the expense of enjoying life.

- You feel a sense of control and security when your savings grow.

- You have difficulty spending money, even on things you need.

- You skip social events to avoid spending money.

- You hesitate to invest in opportunities that could yield higher returns.

Problems associated:

- Missing out on experiences, hobbies and activities that require spending.

- Potential strain on relationships due to frugality.

Money advice:

Allocate a specific portion of your income for leisure activities and self-care.

Explore low-risk investments like bonds or balanced mutual funds to grow your savings while maintaining security.

Define clear goals for both saving and spending, so you can enjoy the present while planning for the future.

2. The Compulsive Spender

Compulsive Spenders have a love for shopping and often make impulsive purchases.

Signs that you might be a “Compulsive Spender”:

- You love shopping and often make impulsive purchases.

- You struggle to resist sales, discounts, and promotions.

- You tend to buy things to feel good or cope with stress.

- You buy items you don’t need or rarely use.

Problems associated:

- Accumulating debt and financial stress due to frequent shopping.

- Lack of savings for emergencies or future goals.

Money advice:

Wait 24 hours before making any non-essential purchase to reduce impulsive spending.

Set clear limits for discretionary spending and track your expenses.

Remind yourself of your financial goals, like saving for a vacation or buying a home, to stay motivated.

3. The Indifferent-to-Money

People who are indifferent to money rarely think about money.

Signs that you might be “Indifferent-to-Money”:

- You avoid thinking about money or managing your finances.

- You rely on others to make financial decisions for you.

- You often feel overwhelmed or indifferent towards financial matters.

- You feel that money doesn’t play an important role in life.

Problems associated:

- While it’s healthy to not be obsessed with money, being too indifferent can lead to financial neglect.

- Financial instability due to lack of planning.

Money advice:

Begin by tracking your expenses and know where your money goes and where you stand.

Learn the basics of budgeting, saving, and investing to gain confidence in managing your finances.

4. The Saver-Splurger

Saver-Splurgers save diligently but then indulge in occasional splurges, often leading to guilt or financial strain.

Signs that you might be a “Saver-Splurger”:

- You save diligently but then splurge on big-ticket items or luxury experiences.

- You often feel guilty after making large purchases.

- You go through cycles of extreme saving followed by excessive spending.

- You save for months and then splurge a large portion on a vacation or expensive gadget.

Problems associated:

- Difficulty building long-term wealth due to inconsistent saving habits.

- Financial stress after splurging.

Money advice:

Set aside a specific amount each month for splurging, so it’s within your budget and doesn’t derail your savings goals.

Consider what truly brings you happiness and focus your spending on those areas.

5. The Compulsive Moneymaker

Compulsive Money makers are driven by a desire to constantly increase their wealth.

Signs that you might be a “Compulsive Moneymaker”:

- You’re constantly looking for ways to make more money, whether through side hustles, investments, or new business ventures.

- You equate your self-worth with your financial success.

- You struggle to relax or enjoy life because you’re always focused on making money.

Problems associated:

- Burnout and stress from overworking.

- Neglecting relationships and personal well-being in the pursuit of wealth.

Money advice:

Ensure you have time for relaxation, hobbies, and relationships, even as you pursue financial success.

Reflect on what success means to you beyond financial achievements, such as personal growth, relationships, and health.

6. The Gambler

Gamblers are drawn to high-risk, high-reward financial decisions.

Signs that you might be a “Gambler”:

- You enjoy taking risks with your money, whether in the stock market, gambling, or speculative ventures.

- You thrive on the excitement of potentially high returns.

- You invest in highly volatile stocks or cryptocurrencies without thorough research.

Problems associated:

- Significant financial losses due to high-risk behavior.

- Emotional stress and potential addiction to the thrill of gambling.

Money advice:

Only allocate a small portion of your portfolio to high-risk investments and set clear boundaries.

Educate yourself on the risks involved and make informed decisions rather than impulsive bets.

Looking for a Financial Advisor?

Connect with Fincart for personalized financial advisory services and achieve your financial goals with confidence.

7. The Worrier

Worriers constantly stress about their financial situation, often fearing the worst even when their finances are stable.

Signs that you might be a “Worrier”:

- You frequently worry about money, even when you’re financially stable.

- You constantly think about the future and potential financial crises.

- You tend to over analyze every financial decision.

- You check your bank balance multiple times a day.

- You avoid investments due to fear of losing money.

Problems associated:

- Missing out on growth opportunities due to excessive caution.

- High stress levels impacting your mental and physical health

Money advice:

Having a safety net can alleviate some of your worries. Aim for 6-12 months’ worth of living expenses.

Spread your money across different asset classes to reduce risk and grow your wealth steadily.

Consider working with a financial advisor to create a plan that provides both security and growth.

| Money Personality Trait | Financial Behaviour | Pitfalls |

| Compulsive Saver | Prioritizes saving over spending. | Neglects necessary spending, may not enjoy life. |

| Compulsive Spender | Frequently makes impulsive purchases. | Accumulates debt, financial stress. |

| Indifferent-to-Money | Neglects dealing with finances. | Faces financial instability or dependence on others. |

| Saver-Splurger | Alternates between saving and splurging. | Inconsistent savings, financial strain. |

| Compulsive Moneymaker | Obsessed with increasing wealth. | Risk of burnout, neglects life satisfaction. |

| Worrier | Overly cautious, constantly anxious about money. | Misses out on opportunities, overly conservative. |

| Gambler | Attracted to high-risk investments. | Potential for significant financial losses. |

Conclusion

Understanding your money personality is key to making better financial decisions. By recognizing your tendencies, whether you’re a Worrier, Spender, or Moneymaker, you can take steps to manage your finances in a way that aligns with your goals and values. Remember, the goal is not to change who you are but to use your strengths to your advantage and mitigate any potential weaknesses.

FAQs

How does my personality affect my financial decisions?

Your money personality influences how you spend, save, invest, and manage debt, shaping your financial habits and long-term financial success.

Can understanding my money personality help me improve my finances?

Yes, understanding your money personality helps you identify spending patterns, correct financial weaknesses, and make better budgeting, saving, and investment decisions.

Explain how your money personality affects your spending behavior?

Spenders tend to make impulsive purchases, while savers prioritize financial security. Investors focus on wealth growth, whereas risk-averse individuals may avoid financial opportunities.

How can your money personality affect your ability to save?

If you’re a natural spender, saving may be difficult, while disciplined savers prioritize financial goals. Recognizing your tendencies allows you to adjust habits and improve savings strategies.