Table of Contents

ToggleThe 90s were the times when the cost of education was low. The importance of child education has been there since the ancient period but was segregated by the caste system. From Vedic times to the current computer age & e-learning, India has progressed a lot. The education system had its struggles but eventually, it outgrew it.

The current challenge that people are facing is the rising cost of education. Being a parent, your primary focus becomes on making your child’s future secure. However, the rising costs have created a stressful aura around the education system. Thus, a child education plan is the ideal investment option, serving as the sole rescuer to create a good corpus for your child & beat inflation too!

Well, in this blog learn about the 4 top reasons to invest in a child education plan:

1. To beat the rising education inflation

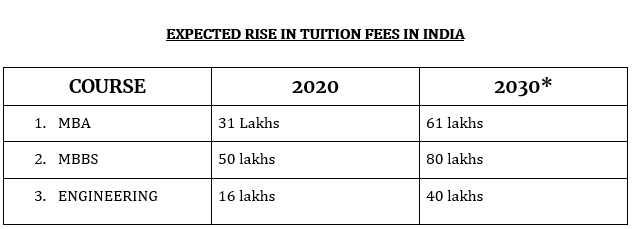

The credit for rising education costs goes to inflation as it is silently killing the dreams of many students. Every parent wants their child to excel and thus, with rising inflation, they have to shell out even more money. This is where a child’s education plan comes into play. Starting early with a child’s education plan helps to save a major chunk till the time they turn 18. The cost of education is not only high abroad but also in India for instance, an MBA course today is somewhere between 20lakhs to 40lakhs.

*Future projections are based on an analysis of the past. *SOURCE: Moneycontrol

Also Read: How a Child Education Plan Can Save You From Education Inflation

2. High Competition

The competition in the education sector is quite high & Indian students face a lot of it. Did you know that there are only 45000 medical seats for which about 12 lacs students appear for the NEET exams? Students scoring 95%+ too face challenges in getting into a government college. The cost of education in government colleges is quite low, however, even the brightest students tend to not get the respective seats. It’s not their fault as they are competing with lakhs of students.

For pursuing the course your child may end up going to a private college/institution. The fees in private colleges/institutions are skyscraping. Thus, preparing for such a scenario is crucial even if your child is the brightest student.

3. The combined benefit of Education and Protection

There are many financial products in the market for a child education plan that comes with protection & education. Unit linked Insurance Plan serves this purpose by giving the facility of both insurance & investment.

Life is unpredictable and thus plans like ULIP secures your child financially from all the uncertainties in life! It is an advisable thing to do to get insurance too when purchasing a child education plan for them, to be on the safer side. God forbid if the breadwinner is no more, then the insurance will ensure that your child will get the premium amount once he/she is of that age.

4. Additional benefits of Tax deduction

The best thing about a child education plan is that it offers significant tax-saving benefits. As per Section 80C, a premium paid on a child education plan is eligible for a tax deduction up to Rs. 1.5 lakhs in a year.

Tax benefits after maturity can also be availed after the maturity of the policy under Section 10(10D). So, why restrain yourself from getting a child plan, as it can give you the best of both worlds? One, securing your child’s education by being financially prepared, and second, you get tax-free benefits!!

Also Read: Benefits of Filing Income Tax Returns on Time

BOTTOM LINE:

Among all these reasons the top reason is to safeguard your child’s financial future & a child’s education planning is capable enough to do this. Early planning benefits both the child & parent as your investment in a child’s education plan gets compounded. The longer the tenure the more corpus you can generate! Their dreams are your dreams & only you can help them financially to achieve those dreams.