As much as it is crucial to make plans for your family, it is equally important to ensure that they are achieved when you’re no longer there. Term insurance is an excellent financial tool to help your family live a worry-free life and achieve their life goals in case anything misfortunate happens to you.

But there are certain things that you must keep in mind when buying a term insurance plan. It’s really important to make the right choices from the beginning and avoid any mistakes when you are purchasing the plan.

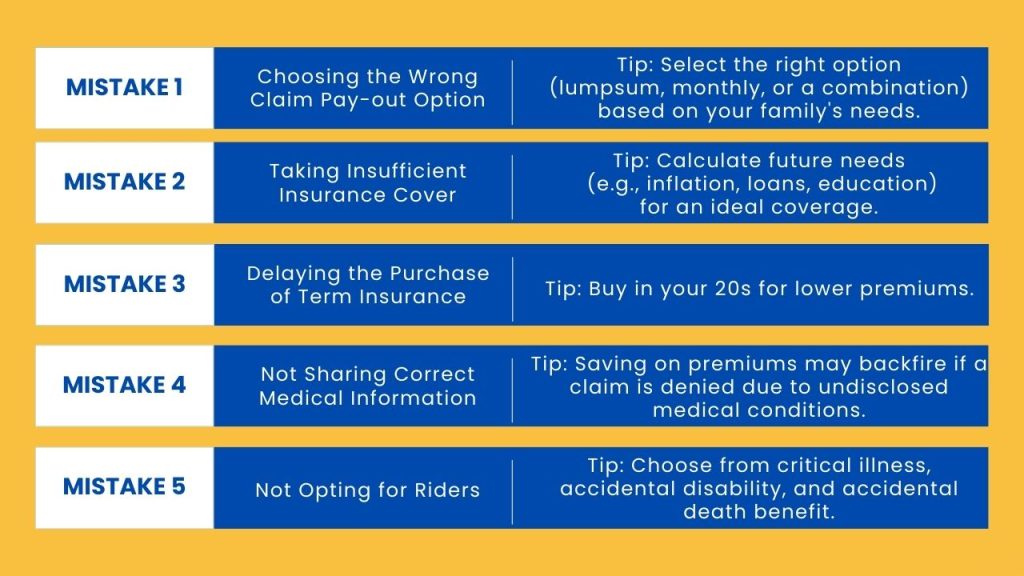

Given below are some of the most common mistakes that people make:

#TermInsuranceMistake1

Consider Mr. Rupesh Sharma, a professor at a private college, aged 39 years old. He was physically fit, ran half marathons quite regularly. He was a sorted gentleman who would take out time to self manage his finances. He bought a term insurance policy of Rs 1 crore from an online portal, choosing the option that required him to pay the least annual premium.

Unfortunately, he had an untimely death while running. He is survived by his wife and three children aged 9 years, 6 years and the youngest one was 6 months old when he passed away.

When his wife approached the Insurance company for the claim, she was shocked to learn that the claim money of Rs 1 crore sum assured will be paid to her in the form of monthly payout of INR 83,333/- for a period of 10 years (i.e., 10 lacs per annum for 10 years). Had she received Rs. 1 Crore upfront, this could have multiplied over the period of 10 years. Further, the value of 83,333/- will keep eroding with growing inflation every month.

Why did this happen?

The term insurance policies with such income features are priced lower than the term policies that settle claims by paying the sum assured in a lump sum way. Just buying the term insurance looking at the lowest premium is fatal #mistake1.

Term Insurance is the most essential element of any financial plan. It reminds us of a yesteryear’s advertisement of a pressure cooker, “Joh biwi se karein pyaar, woh prestige se kaise karein inkaar” (English translation – Anyone who loves his wife will never say no to buying prestige pressure cooker). Term Insurance is symbolic that you care for your loved ones who depend upon you financially. It’s for their and your peace of mind, as life is uncertain. It ensures that the family does not have to compromise on their quality of life or have to depend upon someone else for their livelihood or fulfilling their life goals, when you are not around. Financially depending upon someone else shatters the self esteem of the family.

#TermInsuranceMistake2

“Kam Insurance lene ki bimaari” – This was an apt insurance campaign that was run by one of the life insurance companies in the past. The objective was to try to educate the public on the need to take sufficient insurance cover. People tend to take less insurance coverage than what is required of them. This means if something happens to the person, the family might not get enough money, and the insurance won’t be as helpful as it should be.

This kind of mistake usually occurs when the person doesn’t think about future needs like inflation, debts, loans, or the cost of children’s education when deciding how much insurance to get. It’s crucial to estimate the right amount to ensure the family’s financial needs are properly taken care of.

Let’s consider Mr. Sharma as an example. He earns Rs 10 lakh per year and spends Rs 25,000 each month on household expenses (which adds up to Rs 3 lakh annually). On top of that, he has a loan of Rs 30 lakh. If we take into account an 8% inflation rate, his expenses over the next 20 years would be around Rs 1.3 crore, and he might need an extra Rs 30 lakh for the loan. So, to be well-protected, an ideal insurance cover for Mr. Sharma would be Rs 1.6 crore, which is 16 times his annual income. Had Mr Sharma taken a cover of a lesser amount, his family would have faced difficulty in arranging necessary funds.

Therefore, to be on a safer side, first, figure out how much money your family would need if something happens to you, considering all factors like living expenses, education, debts, etc. Then, subtract any financial assets you already have, like mutual funds or fixed deposits. This way, you’ll get a more accurate number for your term life insurance coverage.

Don’t just pick a big number randomly; do the math to determine the right amount.

#TermInsuranceMistake3

Not buying term insurance early in life is another big problem.

Many people mistakenly believe that you only need insurance when you’re older, perhaps after getting married or having a family. However, it’s actually easier and more practical to buy insurance when you’re younger. The key is to remember that the sooner you get your term insurance plan, the lower your premium will be. When you’re in your youth, you’re also less likely to be affected by common health issues compared to when you’re in your 30s or 40s. This healthier state can increase your chances of getting a life insurance policy. So, it’s a good idea to consider insurance at an early stage in life rather than waiting until later.

Suppose if you buy a Rs 1 crore term plan at the age of 30, you pay a yearly premium of about Rs 10,000, totalling Rs 4.5 lakh by the time you turn 75. However, if you purchase the same plan at 45, the annual premium increases to around Rs 30,000. Over the next 30 years, you would end up paying Rs 9 lakh for the term plan. This example shows that the earlier you buy term insurance, the lower the annual premium, potentially saving you a significant amount over the policy’s duration.

| Term insurance coverage | Rs 1 crore | Rs 1 crore |

| Coverage till the age | 75 | 75 |

| Premium per year | Rs 10,000 | Rs 30,000 |

| Age at which the plan was bought | 30 | 45 |

| Total premium over the years | Rs 4.5 lakh | Rs 9 lakh |

#TermInsuranceMistake4

One of the key tenets of insurance is buying on good faith. Any wrong disclosures about health or habit or hiding critical family information could lead to claim rejection. Most common mistakes are made by the occasional smokers, who smoke one or two cigarettes per week. The premium for a non-smoker is much lower than for smokers. People deliberately make the wrong disclosures to avoid paying higher premiums. If the death gets linked to smoking, then this could lead to claim rejection.

Saving a little money on the premium now doesn’t help much in the long run. When you get a term insurance plan, always tell the insurance company everything they need to know. Think about what’s best for your family in the long run.

#TermInsuranceMistake5

Assume Mrs Priya Singh, a 35-year-old marketing executive with a passion for traveling. She recognized the importance of term insurance and decided to secure her family’s future. While purchasing the plan online, she opted for the basic coverage without exploring additional riders.

During one of her adventurous trips, Mrs Priya unfortunately met with a serious accident, resulting in permanent disability. As she faced physical and financial challenges, she turned to her term insurance for support. The basic policy only covered death, offering no benefits for disability or critical illnesses.

Riders are supplementary benefits that can enhance your coverage, providing financial protection in various situations like critical illness, disability, or accidental death. Choosing a term insurance policy without carefully examining the available riders can leave you exposed to unforeseen circumstances. Mrs. Singh, unaware of the importance of riders, faced financial hardships due to her disability, which could have been mitigated with the right rider in place.

Thus, while securing term insurance, it’s crucial not only to focus on the base coverage but also to explore and understand the available riders. This ensures comprehensive protection for you and your family in the face of life’s uncertainties.

Final thoughts

To conclude, when it comes to securing your family’s future, honesty is the best policy. Don’t just buy a term insurance, buy a term insurance at the right time, with the right cover and by disclosing the right information. At Fincart, our commitment to comprehensive financial planning includes guiding you through the right choices in insurance.