Finance Minister Nirmala Sitharaman presented the Union Budget 2024-25 in Parliament on Tuesday. Hopes were high that the Modi government would introduce substantial tax reforms benefiting the middle class and salaried individuals. However, the FM avoided making any major tax relief announcements, with only a few changes under the New Tax Regime. In her seventh consecutive budget, the FM increased the Standard Deduction from Rs 50,000 to Rs 75,000 and adjusted the tax slabs under the new tax regime. The government did not raise the basic tax exemption limits or introduce new deduction benefits under the new tax regime, which has already been adopted by two-thirds of taxpayers.

New Tax Regime (Revised)

Here’s a comparison of the rates revised in the new tax regime. Individuals earning up to ₹3 lakh annually do not have to pay any income tax.

| Tax Slab for FY 2023-24 | Tax Rate | Tax Slab for FY 2024-25 | Tax Rate |

| Up to ₹ 3 lakh | Nil | Up to ₹ 3 lakh | Nil |

| ₹ 3 lakh – ₹ 6 lakh | 5% | ₹ 3 lakh – ₹ 7 lakh | 5% |

| ₹ 6 lakh – ₹ 9 lakh | 10% | ₹ 7 lakh – ₹ 10 lakh | 10% |

| ₹ 9 lakh – ₹ 12 lakh | 15% | ₹ 10 lakh – ₹ 12 lakh | 15% |

| ₹ 12 lakh – ₹ 15 lakh | 20% | ₹ 12 lakh – ₹ 15 lakh | 20% |

| More than 15 lakhs | 30% | More than 15 lakhs | 30% |

Additionally, the standard deduction for salaried individuals has been increased to ₹75,000 from ₹50,000.

Taxpayers with a taxable income of ₹7 lakh can claim a rebate of up to ₹25,000 under Section 87A. The old regime remains unchanged, allowing a rebate of ₹12,500 for individuals earning up to ₹5 lakh under the same section.

Which income tax regime is better?

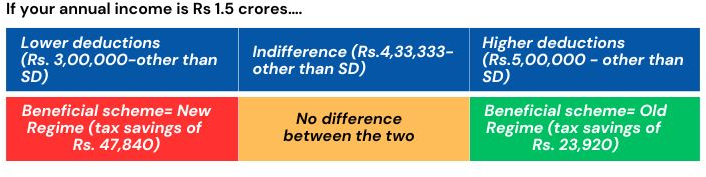

With the revised tax slabs and an increased standard deduction, taxpayers are keen to understand the impact of these changes and determine which regime suits them best.

The choice between the new and old tax regimes depends on individual circumstances, particularly the availability and extent of deductions.

For lower income ranges, the new regime is more advantageous due to the higher rebate, which exempts taxpayers with a taxable income of up to ₹7 lakh, compared to ₹5 lakh under the old regime. For those earning less than ₹7 lakh, the new tax regime can reduce their tax outgo to zero. A salaried employee earning up to ₹7.75 lakh will not have to pay any taxes at all under the new tax regime, thanks to the increased deduction of ₹75,000.

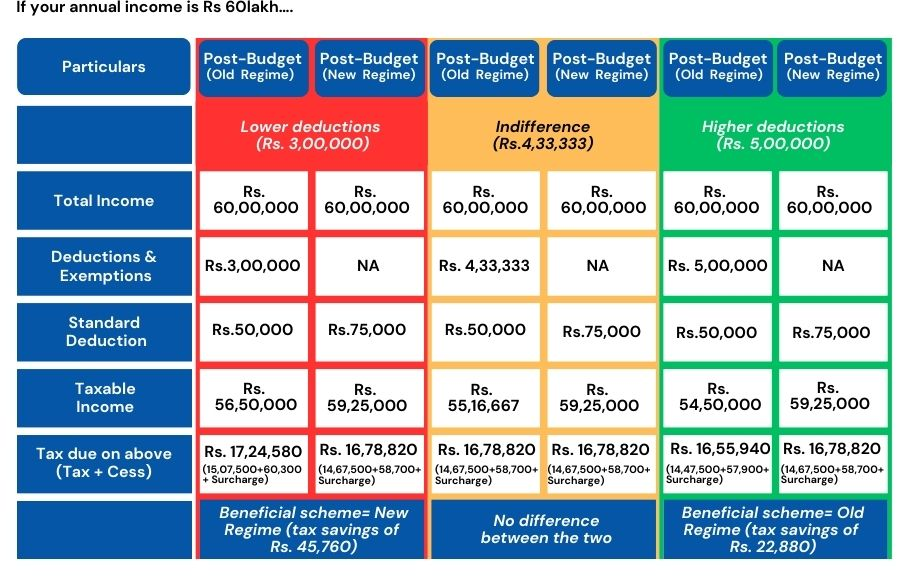

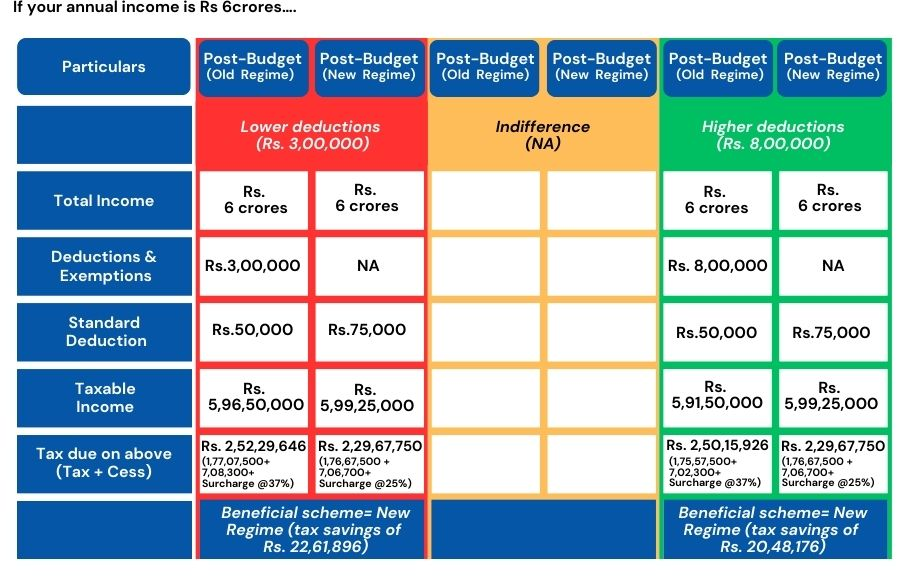

For individuals with significantly higher incomes, such as ₹5 crore, the new and simplified tax regime is more beneficial. The tax payable on this income is lower due to a reduced surcharge rate of 25 percent, compared to 37 percent under the old regime.

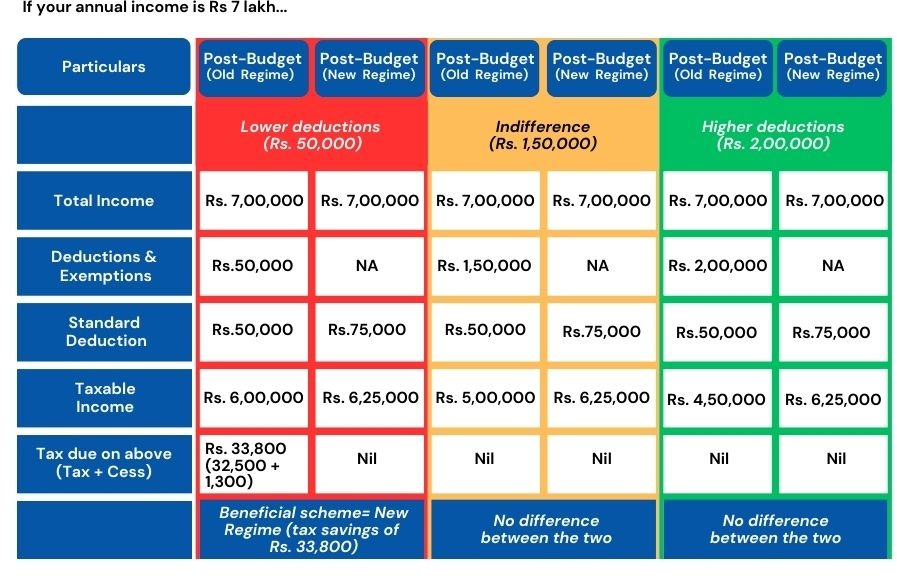

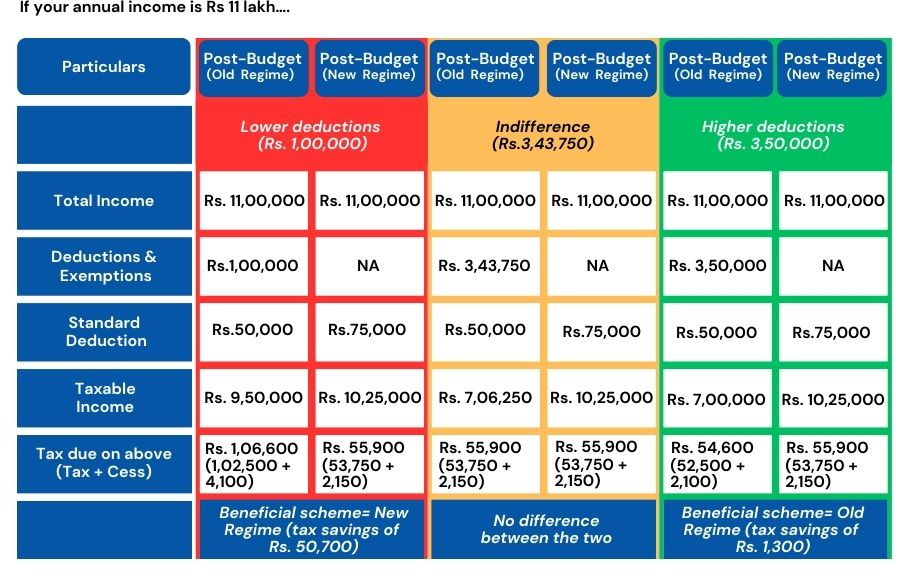

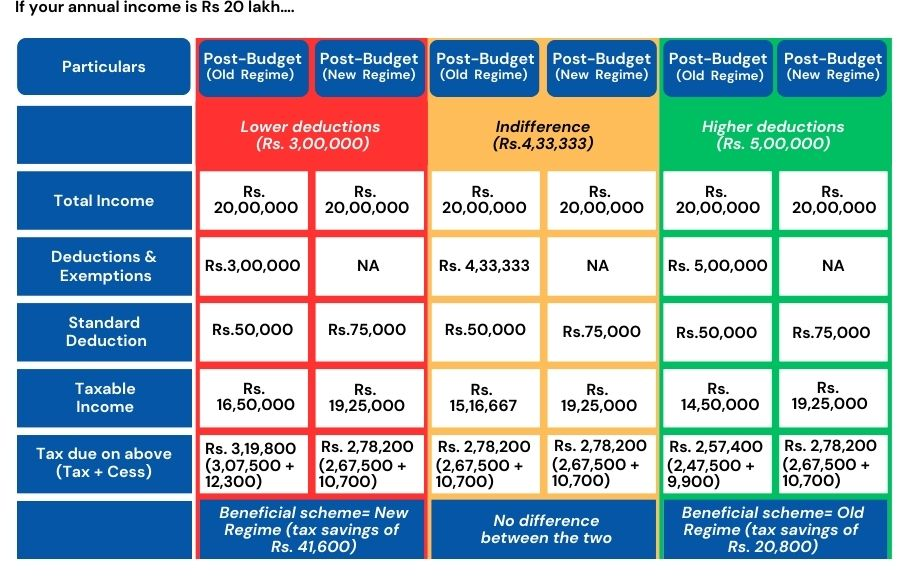

The following table illustrates which regime is more beneficial at various income levels and how one can achieve parity between the two regimes by claiming the necessary deductions under the old regime.

Don’t fall behind your taxes!

Get in touch with Fincart to handle your taxes and optimize your savings.

Calculations for FY 2024-25:

Notes:

- The above rates are used for resident individuals (less than 60 years of age).

- Tax outgo under the new and old regimes will be zero for taxable incomes of up to Rs. 7 lakh and Rs. 5 lakhs respectively due to the rebate u/s 87A.

- These incomes do not include any income taxable under special rates.

- “Indifference point” is the level of deductions at which your tax outgo under the old regime will be at par with that under the new regime.

- If your deductions are higher than the “Indifference point”, the old regime is beneficial. Otherwise, the new regime.

- For those in the lowest and highest tax brackets, the new regime will be beneficial.

- Surcharge rates are the same under old and new tax regimes, except for income above Rs. 5 crores for which the surcharge rate is 37% under the old regime as compared to 25% under the new regime.

Conclusion

The revised new regime proves to be a bigger deterrent to staying on in the old regime. While the old regime has more deductions that encourage investing and insuring, the tax brackets are also much higher. To keep your taxes as low as the new regime, you need to have significant deductions.

So, if you claim multiple significant deductions under the old regime, such as home-loan interest or house rent allowance (HRA), your tax liability will be lower. For low-income earners and individuals with fewer deductions, the new, simplified regime will score.