Table of Contents

Toggle“A good education is the foundation of a better future”- Elizabeth Warren

From petrol to vegetable hikes, Inflation is raising the prices of everything. You might be so engrossed in the daily rising of prices, that you might not consider other sectors like education.

The education sector has seen a quantum leap in terms of inflation. This situation is worrisome for both parents and students as it impacts dreams & aspirations to enter a good college. Even the pandemic couldn’t stop education inflation from rising. How?

Well, for example, the Indian Institute of Technology (IIT) doubled its fee from 90,000 to 2 lakhs for an undergraduate course in 2023.

The majority of unprepared parents faced financial difficulties. Even those with a child education plan faced difficulties. However, if the case of inflation was considered while availing a child of education then those parents were off the hook!

How Will the Education Inflation Rate Impact in the Coming Years in India?

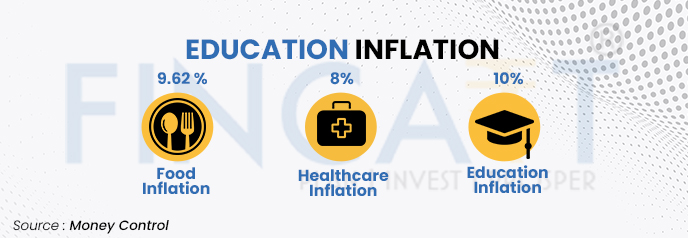

Before getting into this, let’s first understand what education inflation is. As you can see from the image, it shows that the education inflation rate in India has surpassed both food and healthcare inflation rates.

The reasons why education has taken a big leap are numerous. These factors come from a higher cost of living to increased tuition fees, from administration costs to technology & infrastructure, etc. Not only this, after all these costs come the hidden charges like exam registration fees, transportation costs, accommodation & food costs add further to it.

Increase in Tuition Fees

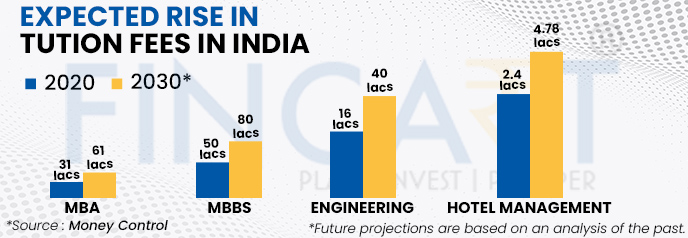

Over the years, an increase in tuition fees can be seen. There are comprehensive courses that have seen a hike in their costs. Not only this, mentioned below courses are expected to go up based on their hike in the previous years.

Having an education plan will help you to manage the coming inflation.

Expected Rise in Tuition Fees in India

Rise in Abroad Education

Rising inflation and the falling rupee value are damping the dreams of students who wish to study abroad. From education to living expenses, you can see a price rise. Due to this to manage the cost over there, many students take up part-time jobs as well.

When the cost of education is at its peak in India then imagine how much it will be abroad. Thus, for overseas education, a hefty amount is required. Did you know that the total cost of an undergraduate program at Harvard University for the academic year 2022-2023 has risen to 2.7% as compared to previous years?

According to The Hindu, “Last year, including visa, college fee, and other charges, a student would spend around 20 to 25 lakh per annum. This year, it will cost around 25 to 40 lakh per annum.”

SIP: A savior in beating Education Inflation

A sudden deadline for paying the fees can become stressful. You might close your FD for that if you have any, take up an education loan, or could ask for financial assistance from your friends or family members.

But all the above stressful situations could be avoided if you just start saving for your child’s higher education. You can start by investing a small amount of money and increasing the amount per increment. The early and the longer you stay invested you get to experience the power of compounding.

Why SIPs for child education?

-

- For saving and investing, the most important thing is having financial discipline. This you can get with investing monthly in SIP because of its recurring nature.

-

- A fixed amount is set for every month’s SIP. Make sure to buy more when the price is low and buy less when the price is high. This benefits you from a lower cost of investing.

-

- The best thing about SIP is that you can start with Rs. 1000 per month and increase the amount as your increments or bonuses. Remember that little drops of water fill the mighty ocean!

-

- Early SIP investment can leverage you with the power of compounding and rupee cost averaging for an extended period.

Bottom Line:

Inflation is a silent killer that will kill you if not taken into consideration. When planning for financial goals like child education or even retirement, you must factor inflation into your planning.