Table of Contents

ToggleEnvision yourself sitting at a restaurant, thinking about what to order. Now you’re stuck with 2 options, whether to go for a platter consisting of a variety of dishes or a single dish. What would be a more preferable option?

A platter, isn’t it? As options of dishes are more here as compared to that one dish.

Well, mutual funds are like that only. In mutual funds, you get multiple options, and multiple varieties to go through. It’s cost-effective too, as you get more variety than the cost of having one dish. Well, in this blog, we’ll be exploring the benefits of mutual funds and uncovering some of the key advantages they offer to investors.

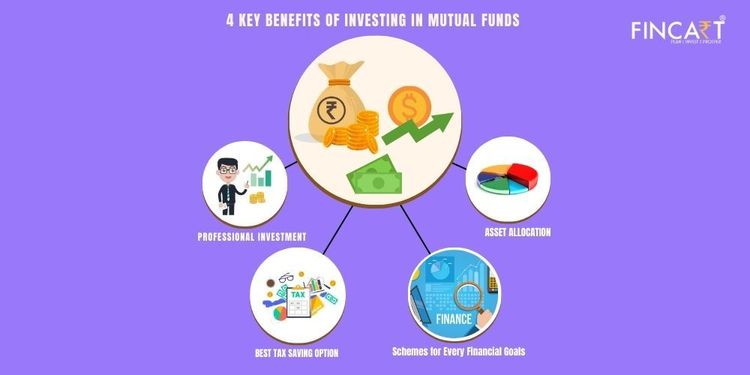

1. Professional investment

The presentation and taste of the platter depend on the restaurant’s quality of food. If the food is good you’ll end up enjoying the supper, but if it’s not you’ll eventually face a negative experience. You might not even visit that restaurant again.

Well, mutual fund investors are too managed professionally, with expert fund managers. These fund managers gain an immense study of the market dynamics, through which they allocate their investments into different stocks. The best thing with mutual funds is that inexperienced investors are also welcomed here, as fund managers take charge here, from stock selection to diversifying it, to make you get good returns.

2. Asset allocation

Just like you customize your platter by opting for certain dishes within it to diversify your platter, in mutual funds too, asset allocation is done that helps in risk diversification. It also reduces the risk for an investor.

Due to asset allocation, if some of your stocks get devalued, other stocks might not. Therefore it prevents a total loss of your investment and gives stability to the portfolio. Thus, creating a less volatile bubble among the portfolio’s overall performance.

3. Best Tax Saving Option

Who would mind a dessert to go with a platter? I believe no one!

Everyone loves a touch of sweetness to go!

Well, just like that, having a Mutual Funds consultant can significantly impact your financial planning. Among other benefits, Mutual Funds bring a sweet advantage of tax-saving options. Consulting with a Mutual Funds expert ensures that you make the best choices for your financial goals, including optimal tax-saving options

ELSS Mutual Funds have a tax exemption of Rs. 1.5 lakh a year under section 80C of the Income Tax Act of 1961.

On Long-Term Capital Gains (LTCG) a 10% tax above Rs 1 lakh is applicable. LTGC has consistently delivered higher returns than other tax-saving instruments in recent years.

Based on the type of investment and the tenure of investment all other Mutual Funds in India are taxed. Unlike other tax-saving schemes like PPF, NPS, and Tax-saving FDs, ELSS Tax Saving Mutual funds have the potential to deliver higher returns.

4. Schemes for Every Financial Goal

Not everyone can afford expensive platters, some prefer reasonable price platters too!

This is the same with mutual funds too, as not every investor can invest a higher amount, thus, the minimum amount of investment can be done from Rs. 500 to the investor’s maximum potential.

Secondly, with SIP, one can enhance its reach to achieve more and more financial goals through effective financial planning. Consider you wish to invest 20,000 in total, then as per your tenure for your goal requirement.

The only point one should consider before investing in Mutual Funds is their income, expenses, risk-taking ability, and investment goals. Therefore, every individual from all walks of life is free to invest in a Mutual Fund irrespective of their income.